This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

Savvy travelers know that using the best travel credit cards is one of the best ways to collect points and miles quickly. This is especially true when credit card companies offer sign-up/welcome bonuses that offer thousands of points/miles right off the bat. But a lot of people are concerned with how these cards could affect their credit. Well, fear no more. Here are 7 tidbits about travel reward cards and how they affect your credit score.

Myth #1: Applying for a new travel reward credit card will ruin your credit

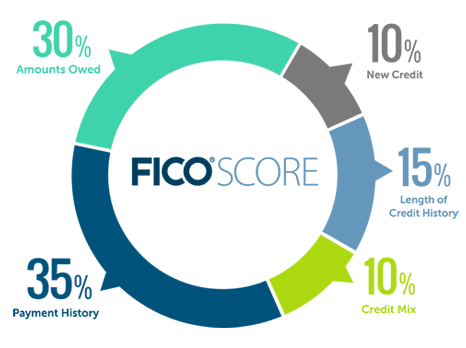

Many people believe that the more credit cards you have, whether they earn travel rewards or not, the more your credit score suffers. Not true. According to FICO, they determine your credit score by many factors, including payment history (35%), how much you owe (30%), length of your credit history (15%), new credit (10%), and your credit mix (10%).

As you can see, new credit accounts for only 10% of your total credit score. More weighty factors are determined by whether you pay your bill on time, how much you owe versus how much credit is available to you across all your accounts, and even how long you’ve been using credit cards.

Also, applying for a new credit card can actually increase your credit score since it raises your credit limit and credit utilization.

Myth #2: Getting denied for a credit card will hurt my credit score

This is a half-truth. Getting declined for a credit card after submitting an application does nothing to lower your credit score. As pointed out above, it’s the application itself that docks your score a few points. Whether you were approved or denied for that particular credit card could have happened for a number of reasons, but the denial itself isn’t anything to be afraid of.

If they do decline your application that’s okay, just be careful about reapplying for a new card right away. An immediate second application could harm rather than help your score.

Plus, too many inquiries are a red flag for potential issuers. Even if your credit is good, automated systems will often deny applications if you’ve applied for several cards within a few weeks or even months.

Myth #3: Having more than one rewards credit card will hurt your credit score

If you worry about having several reward credit cards in your name at once, don’t be. You would need a full drawer of cards before your credit score takes a dive. If you are new to credit card ownership, start with just one or two during the first year and slowly increase from there.

How many are too many? Some aficionados have numerous credit cards, all while maintaining an excellent credit score. Remember, it’s not the number of cards but the quality of management that matters most.

And of course, don’t apply for any credit cards if you can’t manage your credit card spending responsibly.

Myth #4: Canceling credit cards will boost your credit score

Canceling a travel reward credit card account actually has more of a negative impact than applying for a new card. Closing your accounts affects both the lifetime average of your credit history and the amount of credit available to you.

Canceling a credit card here or there isn’t a big deal if you have several long-standing cards in your name. However, if you are continually applying for and canceling cards, say before the company charges the annual fee, you have a little more to worry about.

Think of it like averages in math. If you have four credit cards that you’ve had for years and you sign up for one more and cancel it a year later, your score will only briefly go down a little.

If the only cards you’ve ever had in your name are ones you only kept for a year and then canceled, your average will be much lower based on both length of credit history for each account and available credit.

It’s best to keep credit card accounts open, even if you aren’t using them very often. If they have a high annual fee that isn’t worth it to you, having other longstanding cards will ease the blow if you do cancel. If you’re just starting out with travel reward credit cards, you might consider signing up for no-annual fee credit cards first.

The sign-up/welcome bonuses will be lower, but they will benefit your credit score in the long run.

Also, before canceling a credit card, you can ask the bank to downgrade it to a no-annual-fee version. Alternatively, they may even give you a retention bonus to keep the credit card active.

Myth #5: Travel reward credit cards are expensive

While it’s true that some travel reward cards come with hefty annual fees, that’s not always the case. Yes, the Platinum Card® from American Express card comes with a hefty $695 annual fee (See Rates & Fees), but the Chase Freedom Unlimited® has none at all. And yes, the Platinum card is enticing with its large welcome bonus and perks like airline credits and airport lounge passes. But unless you’re absolutely going to use all of those perks every year, it’s not worth the price tag.

Many cards charge $95 annually. That may seem high, but often travel reward credit card sites will offer some kind of tool to help you determine if that fee will be worth it. If your yearly spending is very low, the answer will likely be no. But if you charge all of your expenses to your credit card every month and want to travel often, it might be worth it.

One way to think of it is by comparing the annual fee to that of airfare or purchasing miles from an airline. If you only go on one domestic flight a year and it costs $150, and your spending only earns enough points or miles for half that flight, you’re not getting such a stellar deal.

However, if you plan on frequently flying to far-flung destinations where the airfare is in the quadruple digits, and you spend enough in a year to pay for that with points, it’s a no-brainer to pay the annual fee.

Myth #6: The high-interest fees aren’t worth the high-interest rates

It’s true that interest fees for many types of reward cards are higher than for basic bank credit cards. Fortunately, interest does not accrue unless you don’t pay off your bill in full before the due date. As long as you pay off the balance of your travel reward credit cards every month, the points and miles you receive for your spending are totally worth it.

But if you don’t, most of the rewards you receive won’t be worth much, if anything, at all. So if you tend to be forgetful, enroll in automatic payments, sign up for email alerts, schedule payments on your calendar, and do whatever it takes to ensure you pay on time. Keeping a balance hurts your credit score anyways, not just on reward credit cards.

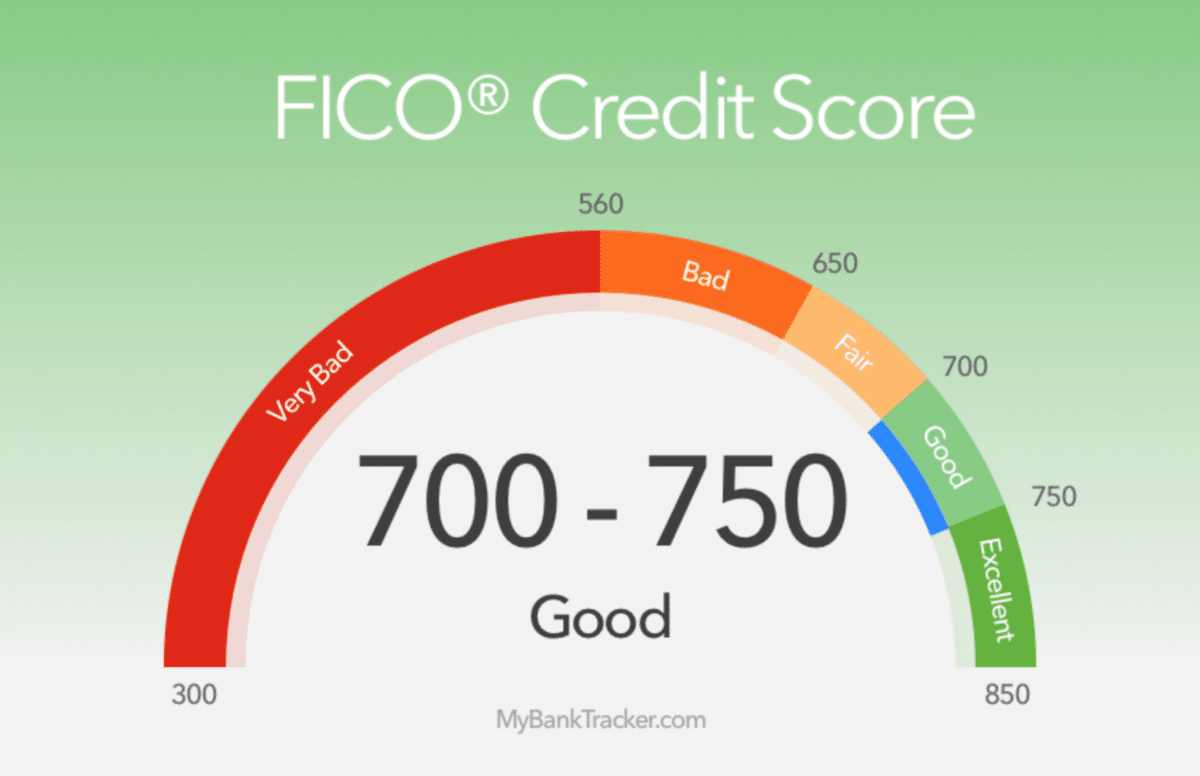

Myth #7: You can’t get a travel reward credit card if your credit score isn’t excellent

Many travel reward credit cards do require an above-average credit score to apply. So those with middling or below-average credit might have trouble acquiring some of the cards with the best bonus and point-per-dollar values. However, there are certainly reward credit cards available to those with less-than-stellar credit.

The key to getting the most out of travel reward credit cards is picking the ones that are right for you. Manage them wisely to get the most out of them without hurting your credit score in the process.