This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

If you have one of the Southwest Airlines Rapid Rewards® credit cards, you were probably doing a little happy dance when they recently announced nonstop flights from California to Hawaii. Southwest even offered a limited time, promotional $49 fare (which sold out before you could say Honolulu). If you weren’t able to grab the $49 fare, don’t be too bummed. You can still use your Southwest Rapid Rewards® credit card points to help get you to Hawaii.

Here is Southwest Airlines’ current line-up of credit cards:

- Southwest Rapid Rewards® Priority Credit Card

- Southwest Rapid Rewards® Premier Credit Card

- Southwest Rapid Rewards® Plus Credit Card

- Southwest® Rapid Rewards® Premier Business Credit Card

- Southwest® Rapid Rewards® Performance Business Credit Card

Here’s are a few different options to use your points to get you to Hawaii.

First, calculate your points

The general rule of thumb for rewards miles or any credit card rewards is that they are usually worth $0.01 each. Figure out the value of your points based on Southwest’s Wanna Get Away fare, which is the lowest priced fares they offer.

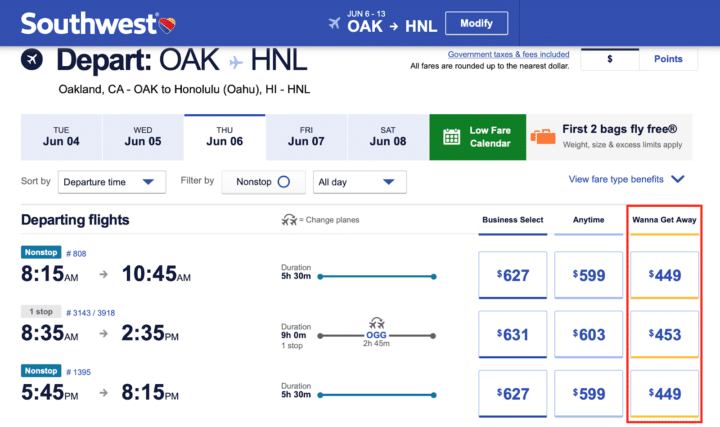

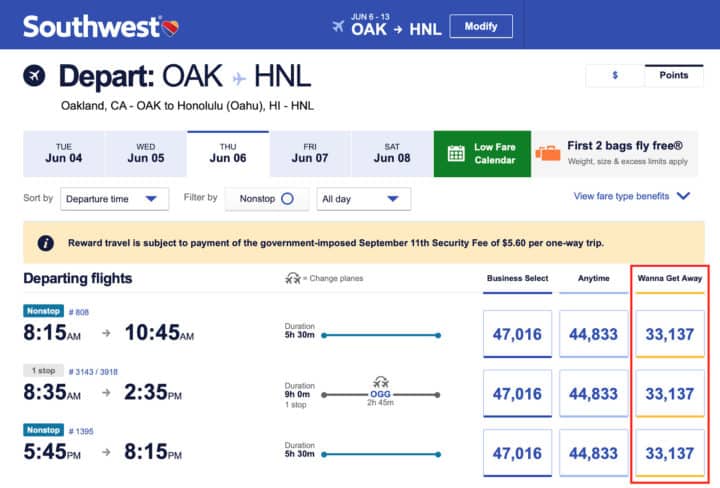

At the time of writing, a roundtrip ticket from Oakland to Hawaii will run you over $450 (plus $48 for taxes) on Southwest’s Wanna Get Away fare.

If you were to use points to get to Honolulu on that same flight, it would run you about 33,000 points for a roundtrip flight on their Wanna Get Away fare. That means the points value for this flight would be about 1.37 cents per mile.

Generally speaking, points from Rapid Rewards will run you about:

- 1.5 cents per point for Wanna Get Away fares

- 1.1 cents per point when you use them for Southwest’s more pricey Anytime fares

- 0.9 cents per point for the Business Select fares

Of course, this was with my example. However, these numbers are a good general estimate.

Option 1: Transfer your Ultimate Rewards points to Southwest Airlines

If you use Chase credit cards that are part of Chase Ultimate Rewards and have some points to spare, you can transfer them directly to your Southwest Rapid Rewards account at full value, anytime. Your transfer rate will be at a 1:1 rate and you can do this right on the Chase Ultimate Rewards website that is linked to your credit card.

Since Southwest Airlines is one of Chase’s travel partners, you can transfer in 1,000-point increments to your Southwest Rapid Rewards account.

The following credit cards earn Ultimate Rewards points:

- Chase Sapphire Reserve®

- Chase Sapphire Preferred® Card

- Chase Freedom®

- Chase Freedom Flex℠

- Chase Freedom® Unlimited

- Ink Business Preferred® Card

- Ink Business Cash® Credit Card

You can also transfer your Marriott Bonvoy points to Southwest at a 3:1 ratio.

Note that you can transfer points to your Southwest account but won’t be able to move them back to your Chase credit card account.

Should you transfer your Ultimate Rewards points to Southwest Airlines?

You probably need to do some thinking before you transfer your points from Ultimate Rewards to Southwest, which is perfectly understandable. Here are some things to consider if you’re not familiar with flying Southwest.

Here’s the good:

- Southwest consistently offers low-cost fares

- You get two free checked bags (other airlines charge around $30 for the first checked bag)

- Flexible change and cancellation — they don’t charge fees if you change your flight. If you cancel your award ticket, you can get your miles refunded.

- The infamous Southwest Companion Pass® — your spouse, buddy, bestie, lover, neighbor, etc. can fly with you for free (minus taxes and fees for the ticket). You can earn this pass after accumulating 135,000 points for one calendar year.

Here’s the not-so-good:

- They don’t offer as many routes as major airlines.

- There’s no assigned seating.

- Plus there’s no first-class or business seating.

- Points expire after 24 months if there is no activity in your account. As long as you keep your account active, i.e. use your Southwest credit card, buy points, book a hotel, it should not be a problem.

Take all of this into consideration, especially if you live near an airport that Southwest is part of.

Option 2: Book Southwest Airlines travel through Ultimate Rewards

Use can also use the Ultimate Rewards portal to book or redeem your Southwest travel, which gives you more value for your points.

Specifically, you may earn:

- Chase Sapphire Preferred® Card: 25% more (1.25 cents per point)

- Ink Business Preferred® Credit Card: 25% more (1.25 cents per point)

- Chase Sapphire Reserve®: 50% more (1.5 cents per point)

You’ll have to call in order to book your flight since Southwest flights don’t show up in an Ultimate Rewards search. Call a Chase travel advisor at 866-951-6592 to book a Southwest flight.

More Ways to Earn Points (to Get you to Hawaii) with Southwest Airlines

If you’re a Rapid Rewards member, you can earn the following points for tickets you buy on Southwest:

- Wanna Get Away: 6X points per dollar on the base fare

- Anytime fares: 10X points per dollar on the base fare

- Business Select fares: 12X points per dollar on the base fare

Don’t forget to maximize on points for certain spending categories for your Southwest Rapid Rewards credit card.

Use your Southwest Rapid Rewards credit card to buy your Southwest Airlines ticket online or make purchases on their Rapid Rewards Hotel and car rental partners to earn 2 points per $1.

Pro tip: Sign up for Rapid Rewards Dining program to earn 3 points per $1 spent at restaurants in their dining program.

Before You Pack Your Bags (Remember, the First Two are Free on Southwest Airlines)

If you find yourself traveling frequently on Southwest, it may make sense for you to consider transferring your points. Maximize your points by using your Chase Ultimate Rewards with your Southwest Rapid Rewards account. Once you understand how it works, it’s a pretty straightforward process that can be completed instantly on Ultimate Rewards.

Lastly…

If you don’t already have one of Southwest Airlines’ credit cards, here’s a brief rundown:

Southwest Rapid Rewards® Priority Credit Card

- Annual fee: $149

- Perks: $75 annual Southwest travel credit, four boarding upgrades per year, 7,500 bonus points on your anniversary

Southwest Rapid Rewards® Premier Credit Card

- Annual fee: $99

- Perks: 6,000 bonus points on your anniversary

Southwest Rapid Rewards® Plus Credit Card

- Annual fee: $69

- Perks: 3,000 bonus points on your anniversary

New Southwest Airlines (consumer) credit cardholders can earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Additionally, all three cards get 25% back on inflight purchases.

Southwest® Rapid Rewards® Premier Business Credit Card

- Annual fee: $99

- Perks: 6,000 bonus points on your anniversary

- Bonus offer: New Southwest® Rapid Rewards® Premier Business Credit Card cardholders can earn 60,000 points after spending $3,000 on purchases in the first 3 months the account is open.

Southwest® Rapid Rewards® Performance Business Credit Card

- Annual fee: $199

- Perks: 9,000 bonus points on your anniversary

- Bonus offer: New Southwest® Rapid Rewards® Performance Business Credit Card card members can earn 80,000 points after spending $5,000 on purchases in the first 3 months from account opening.

Are you planning a trip to Hawaii using your Southwest credit card? Let us know in the comments below.

If I no longer hold one of SW Rapid rewards card but still have the points in my rapid rewards account, can I apply for a Chase Ink card and transfer the bonus points to my RR account to use on travel?

Yes, you absolutely can!

If I transfer the 80,000 points from chase ultimate rewards to southwest rapid rewards and book a flight through southwest, doesn’t that value $1200 with southwest points since the rate is .015? For example, 40,000 southwest points equates to $600. So wouldn’t it be more beneficial to transfer the 80,000 points and book through southwest instead of the chase ultimate rewards which would only get me $1000 value with 80,000 points? Thanks!

Yes, you can usually get more value from your points by transferring them to a travel partner instead of booking through the Chase portal.