This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. For an explanation of our Advertising Disclosure, visit this page.

Many travel plans are on pause for the near future until the novel coronavirus travel bans end. Even the largest airlines are reducing their international schedules by up to 90%. Now might be a good time to try for an airline credit card despite the travel slow down.

Is Now A Good Time To Try For An Airline Credit Card?

As with any credit card application, you should be strategic for which airline credit cards you try for. There are several exciting credit card signup bonus offers you can qualify for.

Below are several suggestions to help you decide if now is the best time to show your airline loyalty.

Related: Coronavirus and Safe Shopping With Your Credit Card

Focus On Major Airlines At Your Home Airport

The novel coronavirus pandemic is an unprecedented era for airlines. Airline bankruptcies are a real possibility for smaller carriers. Air Italy and Flybe–already on the verge of bankruptcy before the pandemic–are defunct.

To make sure you don’t earn airline miles that can become worthless, you might get a card from a major carrier. That might be:

These airlines are likely to qualify for a $50 billion federal bailout to stay in business.

Note that the airlines may discontinue less-popular routes to reduce operating costs. If you live near an American Airlines hub, you may get an American Airlines credit card. But you may avoid the airline that only operates a handful of flights from the airport.

However, we may not know what the flight schedules will be until this fall.

Flights Are Cheaper Than Usual

Most airlines are discounting ticket prices to generate revenue as some flights only have a handful of passengers. Low fuel costs also help reduce prices. In some cases, you can find cheap flights up to one year from now.

Having an airline credit card lets you earn miles on these ticket purchases and enjoy other benefits like free checked bags.

The standard advice on booking within six to twelve weeks from departure (to avoid paying too much) is temporarily on hold. However, that doesn’t mean you can’t find a last-minute discount.

For example, you can fly in economy class from New York to Los Angeles for $89 one-way on a legacy carrier. The same route can be as low as $38 one way on Spirit Airlines for a no-frill ticket.

You can also find good deals on business class and first-class seats. While these premium seats aren’t exactly a bargain, they can be more affordable than usual. For example, you can fly coast-to-coast on Alaska Airlines in business class for as low as $450 one way. This is about $200 cheaper than the average cash ticket price.

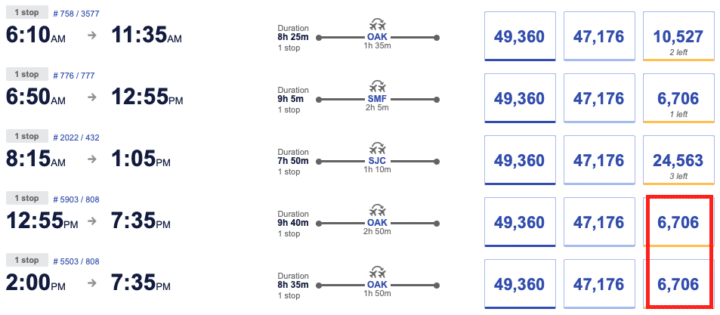

It’s also possible to find discount award flights. One of the best offers can be flying Southwest Airlines to Hawaii. A one-way flight from California to Hawaii can cost 6,706 points (plus fees and taxes). This seat usually costs between 15,000 and 20,000 points each way. Bear in mind that Hawaii may have a 14-day travel quarantine.

You Want To Earn Airline Miles

Getting a card now lets you earn airline miles on each purchase. Many frequent flyer programs no longer have mileage expiration dates. But if your preferred airline does (like American Airlines), each purchase renews your balance.

If the card you want has an annual fee, make sure the benefits are worth more than the fee. Most airline credit cards offer free checked bags, in-flight purchase credits, and priority boarding. If you plan on using these benefits when the sky opens back up, you have the benefits already in place to start using.

Premium credit cards with a minimum $450 annual fee may be a tougher sell at the moment. If you can’t regularly use the luxury benefits like airport lounge access, you might wait to try.

You Can Earn The Signup Bonus

You should try if you can earn the signup bonus by achieving the minimum spend requirement. This might be a difficult task if you’re not making large purchases at the moment.

Thankfully, most airline credit cards have low spending requirements compared to a flexible travel rewards card. The Southwest Airlines credit cards only require you to spend $1,000 in the first 3 months to earn 40,000 bonus Rapid Rewards. Other airlines may require a $2,500 minimum spend or less in the first 3 months.

You Have A Flexible Travel Schedule

A flexible travel schedule makes it easy to find the best award flight prices. An airline credit card may help you avoid close-in booking fees or qualify for complimentary upgrades.

It may take several months before you start redeeming your miles for award flights. For example, you may pay cash for flights because current ticket prices are low. A good strategy may be to save your miles for when flight prices increase but continue earning miles on daily purchases as you wait.

You Will Fly On A Regular Basis

An airline credit card can still be a good option if you plan on flying regularly once the travel advisories lift. Not all business meetings can take place on Skype or Zoom. You may also travel often to visit family. Getting a card now for an airline you normally fly can make sense.

If you’re still unsure what your future travel habits are, consider a flexible travel rewards credit card. These cards let you redeem points for a variety of travel purchases including flights, hotels, and rental cars. This type of travel credit card can also be better if you’re not loyal to one airline.

Related: Cash Back vs Travel Rewards Credit Cards

Capital One Venture Rewards Credit Card

Another solid contender is the Capital One Venture Rewards Credit Card. It earns at least 2x miles for every $1 you spend. You can redeem your miles for travel statement credits on recent purchases. Two other options include transferring miles to airlines and hotels or booking upcoming travel on the Capital One travel portal. The annual fee is $95.

Summary

Now can still be a good time to try for an airline credit card if you plan on flying regularly with an airline and can earn the signup bonus. However, you may also choose a flexible travel rewards card that lets you redeem your credit card points for multiple travel brands. Flexibility can be more valuable now than in the recent past.

FAQs

Is it worth it to get an airline credit card?

An airline credit card can be worth it if you’re loyal to a particular airline. The card can help you earn miles or use benefits like lounge access or free checked bags. The purchase rewards and benefits should be worth more than the annual fee.

Also, make sure you try when you can qualify for the signup bonus. Most bonuses require you to spend between $1,000 and $5,000 in the first 3 months.

If the rewards are worth less than the annual fee, you should consider a flexible travel rewards credit card instead. This card lets you redeem points for multiple airlines, hotels, and car rental agencies. You may also earn bonus points on all travel purchases instead of only for that airline.

What credit score do you need to get an airline credit card?

In most cases, you can qualify for an airline credit card with a credit score of 650 or above. Cards with no annual fee have the easiest approval odds. Premium cards with a $450 annual fee require an “excellent score” of at least 740 to get instant approval.

Most banks offer free credit card pre-approval. This soft credit check doesn’t hurt your credit score and lets you see which cards you most likely qualify for. However, you will still need to submit an official application. This application results in a hard inquiry.

How do you get approved for an airline credit card?

You will need to try for an airline credit card from the issuing bank’s website. Seeking pre-approval can help determine your approval odds. Pre-approval is free and takes less than five minutes to request.

Another option is using a credit card comparison tool like CardMatch. Once you find a card you like, you will try for your desired card on the bank website.

Most banks provide an application decision within one minute. If your approval odds are questionable, the bank may take several days to perform a manual review. This is possible if you have a relatively low credit score, low income, or high monthly expenses.

Related Articles: